An Executive Summary of the report is provided outling the four key report findings.

Executive Summary

The private health sector is an integral component of the Australian healthcare system. Over the last year, private health funds have paid $12.4 billion in benefits towards the healthcare of the 11.7 million Australians who hold some form of private health cover.

The Australian Government operates several policy measures to encourage members of the population to purchase private health cover. Three such measures, the 30% rebate on private health insurance, Lifetime Health Cover and the Medicare Levy Surcharge seek to make private health cover accessible for all consumers.

In 2009, the Australian Government announced that it intended to subject the 30% Rebate on private health insurance to a means test. The proposed policy change would introduce three ‘Private Health Insurance Incentive Tiers’ (tiers) based on income thresholds as well as corresponding increases in the Medicare Levy Surcharge for those tiers.

At the time of this announcement, the Australian Treasury projected that following the proposed policy change only 25,000 high-income consumers would withdraw from their private cover. These Treasury projections are driven by a literature-based assumption that the decisions of high-income consumers to purchase private health cover are not strongly dependent on its price.

This Deloitte Report estimates the economic impacts of the proposed means testing of the 30% rebate. It uses the results of an ANOP/Newspoll survey of 2000 Australian households conducted in early 2011 to determine how private health insurance policy holders will respond to the proposed changes to the rebate.

Based on the ANOP/Newspoll Survey, this report finds that the consumer response following the proposed policy change will be significant and will set in motion a series of inter-related impacts that will flow through the wider Australian healthcare system. Specifically, Deloitte estimates that:

- Significant numbers of consumers will withdraw from their private hospital cover (1.6million consumers over five years) or downgrade to lower levels of private health cover (4.3 million consumers over five years) following the proposed policy change

- Significant numbers of consumers will also withdraw from their general treatment cover (2.8 million consumers over five years) or downgrade to lower levels of private health cover ( 5.7 million consumers over five years) following the proposed policy change

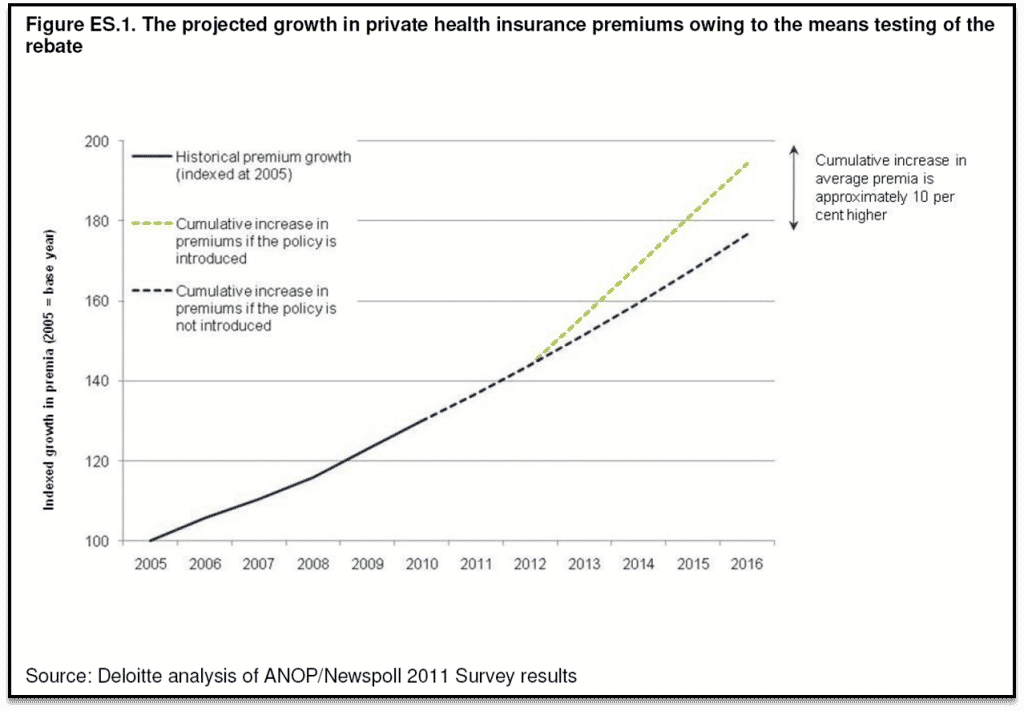

- Private health insurance premiums will rise 10 per cent above what would otherwise be expected. As premiums rise, private health cover will become less affordable for all consumers, that is, not just those who are in the tiers

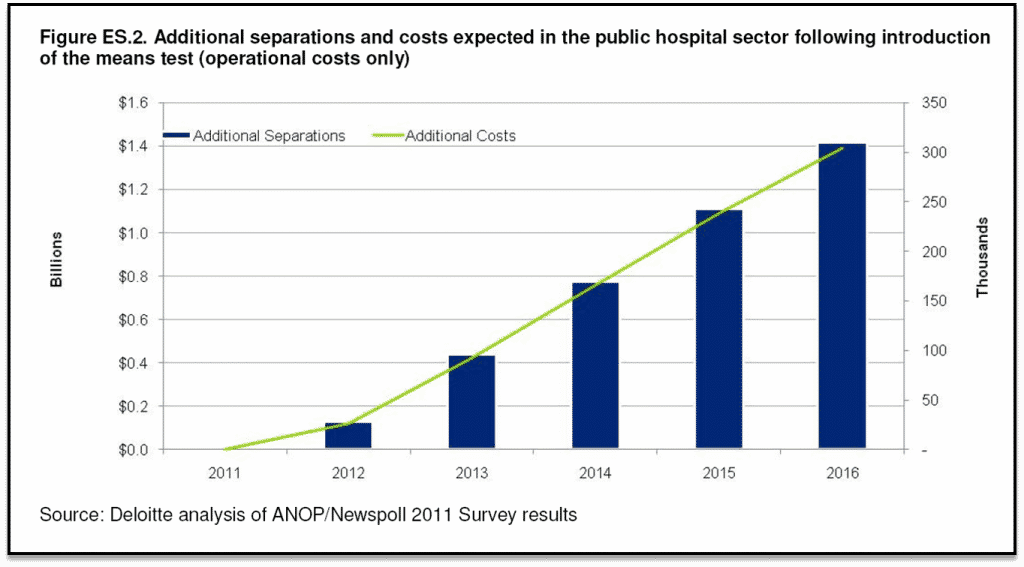

- As people withdraw from private health insurance, the burden on publically provided healthcare rises. The findings indicate that the cost of treating consumers in the public hospital system are expected to rise substantially above what is currently anticipated by Government (Deloitte estimates that additional operating costs accumulated over five years will be $3.8 billion and $1.4 billion in the fifth year alone)

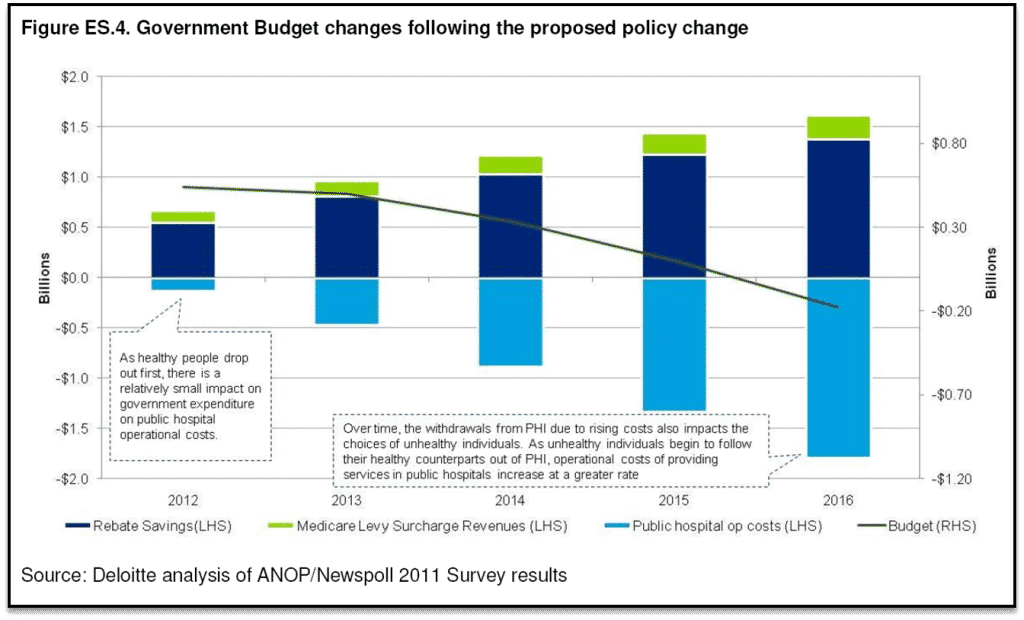

- In time, it is expected that the cost of servicing increased demand for public hospital services will outweigh the savings to government from the means testing of the rebate.

The key findings of the report are briefly outlined below:

Key Finding #1 — Following the proposed policy change, a significant number of consumers are expected to withdraw/downgrade their private health insurance

Following the proposed policy change, Deloitte estimates that:

- In the first year of implementation, 175,000 consumers will withdraw from private hospital cover and a further 538,000 will downgrade. In addition, 554,000 consumers will withdraw from general treatment cover and 803,000 will downgrade

- Over five years, 1.6 million consumers will withdraw from private hospital cover and 4.3 million will downgrade. A further 2.8 million consumers will withdraw from general treatment cover and 5.7 million will downgrade

- Consumers who withdraw from their private health cover are less likely to have claimed healthcare benefits than those who choose to remain

The Deloitte projection of the impact following the proposed policy change is substantially larger than those provided by Treasury. The projections differ as a result of three key differences in the modelling approach employed by Deloitte:

- Predictions of consumer response to changes in the price of private health cover are based on survey results as opposed to a literature review. A literature review, of the potential price sensitivity of private health insurance consumers represents a valid approach. The ANOP/Newspoll Survey, however, presents new evidence and offers the opportunity to revisit analysis of the proposed legislative changes

- The projections consider not only the private hospital cover market but also the general treatment cover market. This is important as consumers are able to withdraw from general treatment cover without facing the Medicare Levy Surcharge

- The projections allow for the option that consumers may choose to downgrade their level of cover in response to the policy change.

Key Finding #2 — Following the proposed policy change, private health insurance is expected to become less affordable for all healthcare consumers, not just those within the tiers

Deloitte estimates that:

- If the policy change is introduced, by 2016, private health insurance premiums will be 10 per cent higher than they otherwise would have been

- This price change will affect all consumers who purchase or plan to purchase private health insurance.Figure ES.1 illustrates projections for growth in premiums over the next five years both under the scenario where the proposed policy change is introduced and the scenario where it is not introduced. The distance between the lines represents the accelerated rate of growth in premiums expected if a means test on the rebate is introduced.

There is a cyclical relationship between the increasing number of consumers ithdrawing/downgrading their private health cover and the continuing rise in premiums.

The Deloitte projections show that year-on-year, the consumers who are less likely to make claims withdraw disproportionately from the private health insurance market in response to increasing premiums, leading to subsequent price rises for all consumers. This projected response is comparable to the ‘adverse selection spiral’ that was observed following the introduction of Medicare, where between 1984 and 1997 private health coverage across the population fell at a rate of 1.4 per cent annually. During this period, research has shown that it was predominantly younger and healthier consumers who choose to withdraw from their private health cover.

While only private health insurance consumers in the tiers initially will be affected by the proposed policy change, any subsequent changes to premiums that occur as a consequence of the remaining consumers’ greater average propensity to claim will be borne by all private health insurance consumers. The Deloitte projections indicate that the greatest decline in private health insurance membership over the five years is among non-tiered private health consumers.

Key Finding #3 — The chain of events triggered by the proposed policy change is expected to place additional burden on the public health system

Deloitte estimates that:

- As people withdraw from their private cover they become more reliant on the public healthcare system. Between 2012 and 2016, 845,000 additional separations will need to occur in public hospitals as a consequence of the means testing of the rebate

- Between 2012 and 2016, additional separations which occur in the public system as a result of the policy change will cost the Government an additional $3.8 billion in cumulative recurrent costs over the five years.

In her Second Reading Speech to the proposed change in legislation, the Minister for Health and Ageing estimated that the impact on public hospitals would be limited to the addition of 8000 separations in the two years following the change.7 Based on the ANOP/Newspoll Survey, Deloitte estimates that in this time frame, 123,000 additional separations will occur in the public sector. Between 2012 and 2016, Deloitte estimates 846,000 additional separations will occur in the public sector following the proposed policy change.

Figure ES.2 illustrates the expected rise in additional separations that will occur in the public hospital system as consumers withdraw from private health insurance and the associated increase in public funding costs. In the absence of the proposed policy change, total public sector separations are expected to grow by 15 per cent between 2012 and 2016. Adding the impact of the proposed policy, total public sector separations would be expected to grow 21 per cent by 2016.

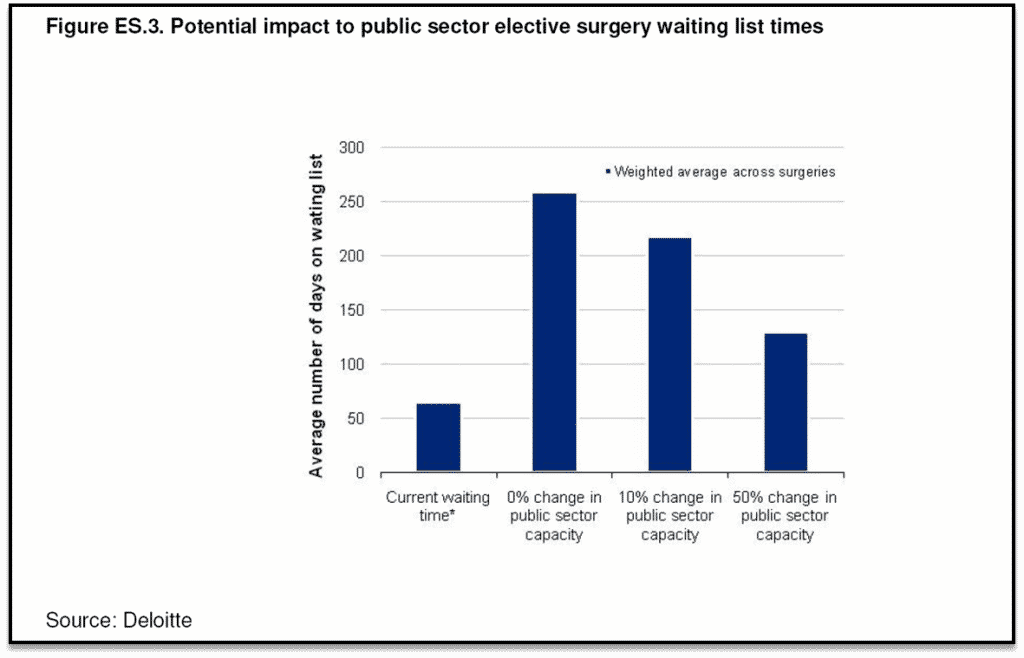

Currently Australian Institute of Health and Welfare data indicate that approximately 1 in 10 consumers requiring hip surgery and 1 in 15 consumers requiring knee surgery wait for approximately a year. Deloitte estimates that the average waiting time would increase from 65 days to 259 days if no additional public capital investments were made in the next five years.

Considering 15 common surgeries, Figure ES.3 illustrates the change in average waiting lists that could be expected under differing levels of government investment in hospital capacity. Deloitte estimates that the average waiting time would increase from 65 days to 259 days if no additional public capital investments were made in the next five years.

Key Finding #4 — The proposed policy change will trigger a series of events that will result in deteriorating government savings, and ultimately net costs to government

Treasury estimates that savings from the means testing will be equivalent to $1.9 billion over four years.

Deloitte estimates that:

- The costs owing to the increase in demand for the public hospital system over these four years will be $2.4 billion

- By the fifth year, total costs resulting from the policy change will exceed the projected savings.

As consumers withdraw and downgrade their level of private cover, they enter into the public healthcare system at a cost to government. The cost of funding increasing demand in the public hospital system will negate the savings to government that are expected from the means testing of the rebate.

In the first four years following the proposed policy change, the estimated savings in rebate payments and additional revenue from the Medicare Levy Surcharge exceed the increase in costs from the proposed policy change. In the fifth year, however, the cost of servicing additional demand in the public sector is forecast to exceed the expected savings (Figure ES.4). This is because additional costs grow at a rate which exceeds the rate of growth in cost savings. For this reason, it is likely that in the years which follow the period modelled, the total savings resulting from the proposed policy change will be less than the additional costs.

The costs estimated by Deloitte do not account for any additional capital investments that may be made in public hospitals to meet additional demand. It is important to note, however, that Australian hospitals are currently operating at average bed utilisation levels of approximately 87 per cent, 10 which implies that some areas are operating at levels higher than this. This suggests that Australia’s public sector hospitals are at or near capacity and would likely require investment in a mix of new beds, operating theatres, skilled labour and other services in order to meet any additional demand.

Full reports are available for download (in PDF format) below:

1 Comment. Leave new

I listened to the debate on this issue in Federal Parliament on Tuesday night, and was horrified with what I heard. Even though most of the speakers were Liberal and National Party members, the facts were scary.

Your report was slagged by Labor as being “bought and paid for” which is an insult. I’m a self funded retiree, who like all Australians and retirees, have been effected by the GFC, and I’ll have to review my private health cover when the premiums increase.