- Private Health sector costs are rising faster than premiums;

- Premium increases of 5.59% due to take place tomorrow are the lowest in 4 years and 15% lower than State Government health cost increases;

- Premium increases at this level are unsustainable in the long run and funds are unable to address obvious rorts in the system without Federal Government action.

While premium increases are lower than in recent years and substantially lower than State Government health cost increases, the industry is far from complacent according to Private Healthcare Australia (PHA) CEO Dr. Rachel David.

With private health insurance premiums rising on average 5.59% tomorrow, the Federal Government must act quickly to ensure that this does not continue to happen year after year.

Private Health Insurance is a highly regulated industry. Some of these regulations now act to keep prices artificially high and lead to obvious rorting of the system. The private health insurance industry cannot act on these issues without Federal government action. Two areas stand out where consumers are being slugged mercilessly. They are the price we pay for medical devices and the actions of State Governments.

PHA CEO, Rachel David said Australian funds pay the highest benefits in the world for medical devices, with private patients forced to pay in some cases up to five times more than international consumers or public patients in State hospitals. If private patients were to pay the same prices for medical devices that are paid by State Governments, consumers would save $800 million overnight. The figure would be much higher if we paid internationally referenced prices, as we already do with pharmaceuticals. We call on Government to fast track reform to the outdated prosthesis list, which sets the prices we must pay and which allow for these rorts to continue.

“Government must not drag its heels on promised initiatives such as reform of medical device pricing, as 11 million Australians are directly impacted by inflated medical device prices putting upward pressure on premiums” she said.

The other area for obvious action is the behavior of State Governments. Over the five-year period from 2008, the number of private patients in public hospitals has increased by a massive 67.3%. This aggressive cost shifting by State Governments is paid for by ordinary Australians through their private health insurance premiums.

Dr. David said these issues are easily fixed. The Private Health industry had given the Government a guarantee it would pass on every dollar in savings to its members from prostheses pricing reform. In good faith, we have already generated a reduced premium increase for this year, factoring in savings from reform of the outdated scheme.

“Health funds cannot however act alone to control health inflation and the Federal Government must come to the party with regulatory reform that will benefit consumers. Government and industry need to work together to ensure the sustainability and affordability of private health insurance in Australia. Minister Ley has made a good start, but delivering on these changes is now urgent”.

PRIVATE HEALTH INSURANCE FACT SHEET

More than 13 million Australians rely on private health cover to ensure they receive the best available health care where and when they need it. Private Health Insurance relieves pressure on the public hospital system, benefitting all Australians.

In 2014-15, private health insurance paid for over 2.21 million elective procedures involving surgery in hospitals, an increase of 2% from the previous year.

With approximately two-thirds of elective surgeries being performed in the private healthcare sector, the sector is a critical pillar of Australia’s health system. 83% of separations in private hospitals are funded by Private Health Insurance.

In addition, Funds paid $1.65 billion to public hospitals in 2014-15 for the treatment of private patients, of which $173 million was for medical devices, an increase of 16.3% on the previous year.

Private health funds are forecast to inject an additional $1.2 billion into Australia’s health care system in 2015-16, bringing total expenditure on private health treatments to more than $19 billion.

For every dollar paid towards health insurance premiums, funds on average pay back 86 cents to the consumer in the form of healthcare benefit payments. The industry benefit claims ratio to premium income in 2014-15 was 86.2%

During 2014-15 there was a 7.2% increase in benefits paid out by health funds while the premium increase was 6.18%, demonstrating that the industry is working hard to keep premiums as low as possible, by introducing efficiencies into their own operations.

Funds paid a record $18 billion in benefits in 2014-15 on behalf of their members, including:

- $13.32 billion in hospital treatment – up 7.6 % on the previous year (an increase of $936 million from 2013-14)

- $4.55 billion in ancillary treatment – up 6.3% on the previous year (an increase of $269 million from 2013-14)

- $2.1 billion in payments for medical specialists – up 7.1 % on the previous year. (an increase of $140 million from 2013-14)

- $1.89 billion in payments for prostheses – up 8.9% on the previous year; and (an increase of $155 million from 2013-14).

This year’s average premium increase, 5.59%, the lowest increase in four years, demonstrates the industry’s commitment to keeping premiums affordable for its members.

In addition to paying for access to private hospitals and choice of doctor, private health insurance also provides value by enabling fund members to bypass public hospital waiting lists and receive their treatment when it’s needed.

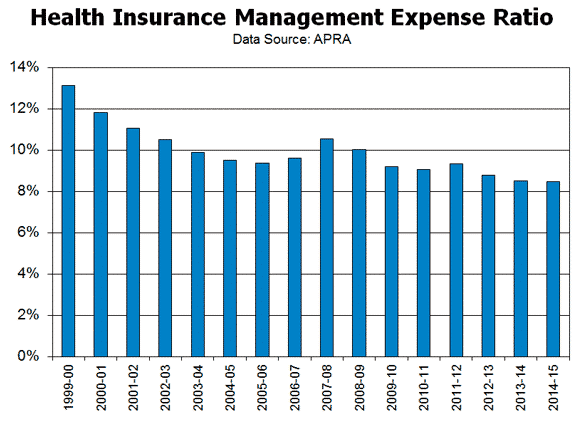

The management expense ratio (MER) for private health insurers has decreased from 13.1% in 1999-00 to 8.40% at the end of 2015. This further demonstrates the considerable effort Funds have made to introduce cost efficiencies and keep premiums affordable.

Media contact: Jen Eddy 0439 240 755