Private Healthcare Australia’s CEO Dr Rachel David said health funds were committed to making it easier for their members to choose and use their health insurance and recognised that complexities had developed in the sector over time.

“Private Healthcare Australia is working with the government and stakeholders through the PHI Reform process to improve specific features of the PHI system including standardised clinical terminology for all health funds to define exclusions, improvements to the privatehealth.gov.au website to help consumers navigate the system, and using a system of labelling products in tiers according to the level of value provided. This will require additional investment by the funds, but it is necessary to improve the customer experience.

“More also needs to be done to improve health literacy in the community, so consumers are better able to assess their own health needs and make the right choices. Many of the health funds have useful information on their websites to help consumers with this, and it’s an area member funds are always looking to invest in,” she said.

Dr David said a Choice survey reporting that Extras cover was not providing consumers with value was nonsense, as it was actually in increasingly valuable component of PHI.

“Health funds are currently paying more in claims for Extras than ever before at $2.9bn for dental claims, and close to $5bn for Extras in total. Extras claims have been growing every year, including as a percentage of the total cost of services.

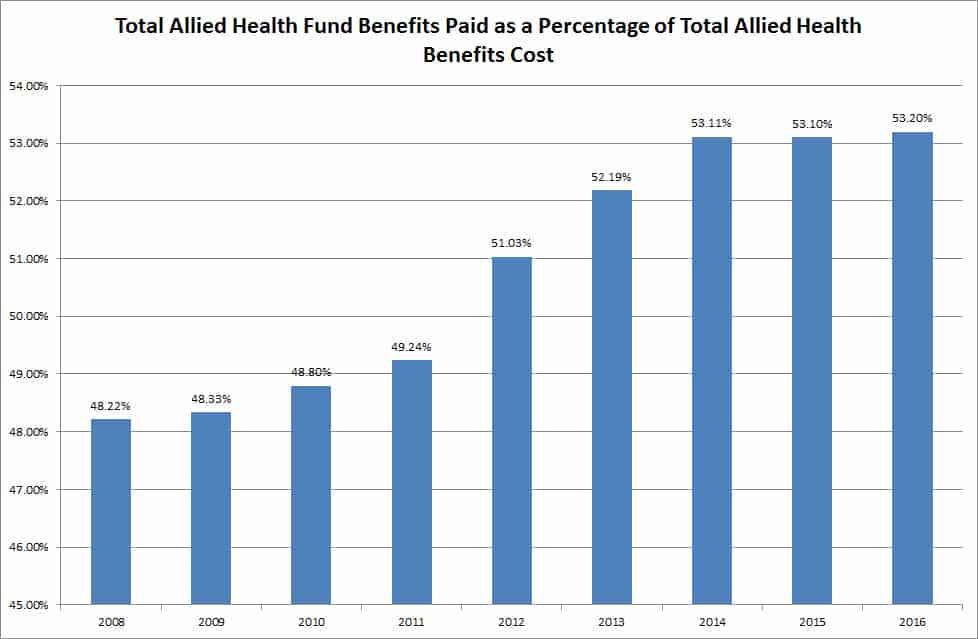

Funds do need to be careful about chasing rising provider fees, particularly since household income growth in Australia has been flat since 2011. This would be highly inflationary on premiums. (see graph)

“Many health funds have gone down the path of contractual arrangements with dental and allied health providers to help address the issue of variable out-of-pocket costs for consumers. This enables them to provide consumers with access to services like no-gap preventive dental care, which is very important in terms of individual and public health.”

Dr David said PHA had surveyed 16 000 consumers in the last 18 months and found that 84% of people with PHI value the product and want to keep it. Most are likely to become very resentful if they are forced to drop or downgrade their cover for any reason. This is particularly true of people aged over 55.

“Premium affordability is their main concern and this is followed by concerns about medical co-payment and out-of-pocket costs, and the complexity of the health system, all issues the industry is working with Government and stakeholders to address.

“Health funds are particularly concerned about medical out-of-pocket as we believe all patients should be able to access informed financial consent and be able to compare costs prior to treatment. This has historically been beyond our control due to the regulatory system in Australia, but increasingly member funds are investing in comparator websites, which will assist consumers and their GPs in accessing this information prior to referral. We are also working with Government on regulatory changes that could possibly make consumer access to this information easier in future.”

Total Allied Health Fund Benefits Paid as a proportion of Total Allied Health Benefits Cost has been growing steadily over the past few years as PHI continues to pay out record levels each year in terms of general treatment services to its PHI members based on growing utilisation across the different modalities (dental, chiropractors, physiotherapy, optical, etc).

Private Healthcare Australia is the peak representative body for Australia’s private health insurance industry. PHA represents 20 Australian health funds with a combined membership of 12.9 million Australians, or 96% of the sector on membership. Promoting the value of private health insurance to consumers in the Australian economy and keeping premiums affordable for our members is the number one priority of PHA members.

Media contact: Steven Fanner 0402 913 603 or [email protected]