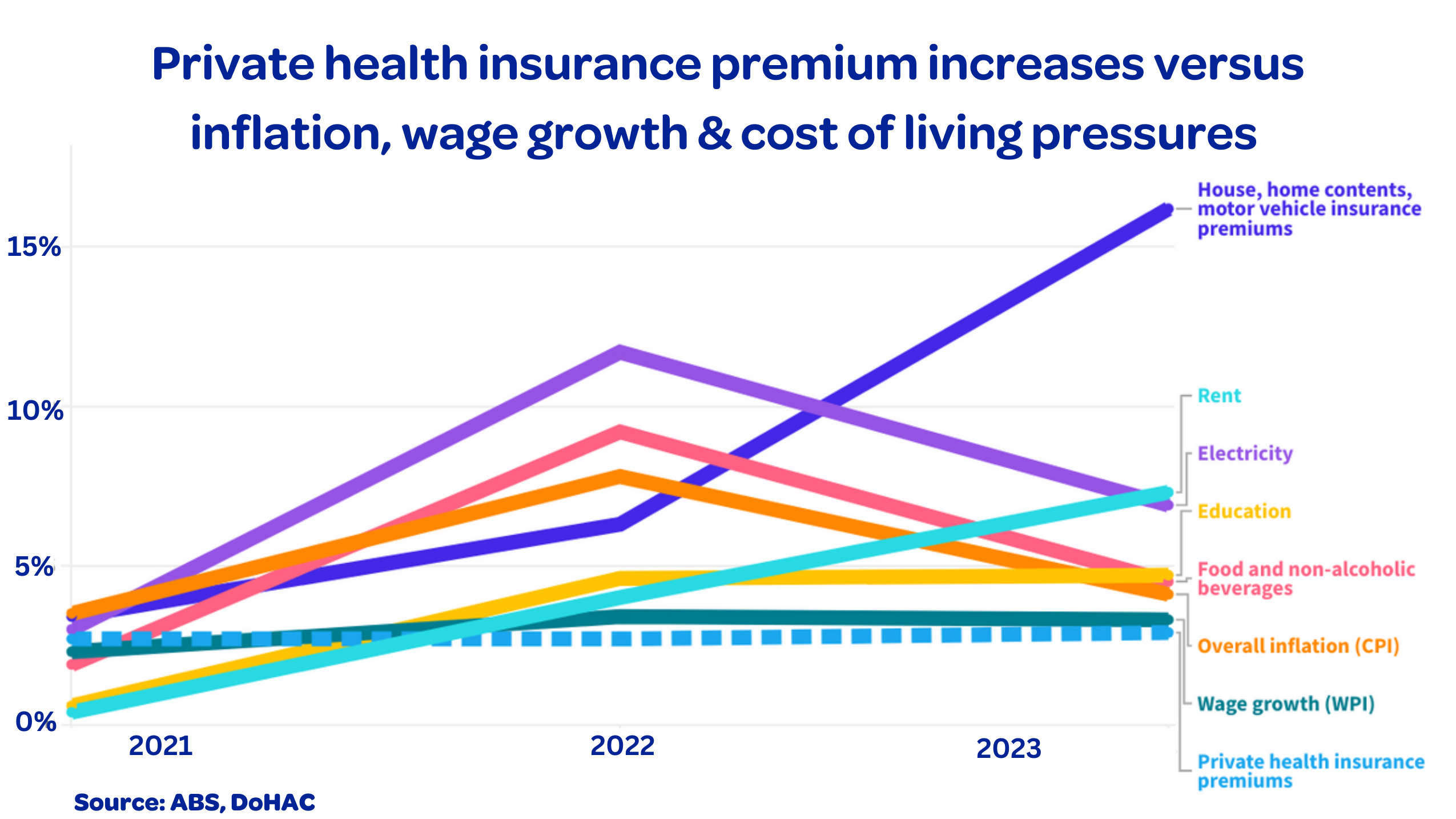

Health fund premiums will rise by an average 3.03% this year, much lower than inflation. Premium increases for other insurance types have surged by up to 16%.

Private Healthcare Australia CEO Dr Rachel David said health funds do not want to increase premiums by a single dollar, given the cost of living crisis, and the need for Australians to continue to get rapid access to healthcare.

Inflation however, is driving up the cost of everything health funds pay for. Over the past twelve months, health inflation rose 5.1%, with medical and hospital services (+6.5%) being the main contributor.

“Health funds are walking a tightrope between keeping premiums as low as possible to maximise access to private health, and providing adequate funding for hospitals and frontline health workers to deliver quality care. Our hospitals need to pay significantly more for staff recruitment, power and food and the funds need to be able to cover these costs. Health funds are also paying more for essential services like cyber security and IT services to support billing and claims.”

The premium rise also follows a 10% jump in health insurance payments for member claims over the past year. The average health insurance premium rise falls well short of other rising household costs including:

- Home and contents, and car insurance – up 16.2%

- Rent – up 7.3%

- Electricity – up 6.9%

- Hairdressing – up 6.4%

- Food and non-alcoholic beverages – up 4.5% (see graph below)

Health insurance continues to provide more value for consumers than any other type of insurance. For every premium dollar paid, 86 cents is returned to members. For general insurance, such as home and contents and car insurance, the return is 65 cents in the premium dollar.

“Australians recognise the value of private health cover. Since COVID, more than one million people have joined a health fund to access quality, timely healthcare, including elective surgery and mental health treatment which can be hard to access in the public health system,” Dr David said.

“Membership is at record levels with 55% of our population covered. That means claims are also increasing. Both hospital and extras claims have skyrocketed in the past year, exceeding pre-pandemic levels. The latest APRA data shows in the year to December 2023, health funds paid a record $23.6 billion for claims – 10% more than the previous year.”

“Our strong private system is taking pressure off the public system, so public hospitals are free for those who need them most. Health funds are now paying for two thirds of all elective surgery procedures in Australia including over 80% of hip and knee replacements and over 70% of cataract surgery in the private sector. But in the current economy, it is becoming more challenging to keep private hospital care sustainable without increasing premiums.”

“We know Australians are doing it tough and that many of our members are not wealthy. Forty percent have a taxable income of $50,000 per year or less and 10 percent of these people are on the aged pension as their only income. They are choosing to contribute to the cost of their own health care, which in turn takes pressure off our stretched public hospitals.”

“Health funds demonstrated their commitment to members during COVID, promising from the outset to return all funds accumulated during lockdowns. The recent ACCC report to the Senate on private health insurance confirmed this commitment had been met. It noted that give backs will total over $4.3 billion, exceeding assessed permanent claims savings of around $4.1 billion.”

But more can be done to reduce costs for consumers. We need policies to:

- Bring the government-regulated cost of generic medical implants and surgical supplies back in line with global market prices. Australians pay 30 – 100% more than people in New Zealand, the United Kingdom, France, and South Africa for commonly used generic medical devices due to an outdated price setting arrangement with multinational medtech companies.

- Remove low value care and harmful medical devices and services from the market as soon as clinical evidence reveals a problem. For example, surgery for chronic back pain is rarely required and usually ineffective, but it is still being done.

- Permit health funds to pay for evidence-based out-of-hospital models of care. Australia lags comparative health systems in the delivery of out-of-hospital care despite evidence showing it is safe and effective for many treatments and that consumers support it.

- Stamp out fraud through continuous monitoring of bulk billing rates and out-of-pocket fees for GP and specialist medical care.

- Introduce US-style ‘Surprise Billing’ legislation to ensure consumers are not liable for fees they have not agreed to before a procedure. This should include civil and criminal penalties for breaches.

“Now more than ever, with cost-of-living pressure and rising healthcare costs, we need all healthcare stakeholders to pull in the same direction to keep our health system sustainable,” Dr David said.

Media contact: Jen Eddy, 0439 240 755